Is buying with friends the future of housing?

Image copyright Alex McClure

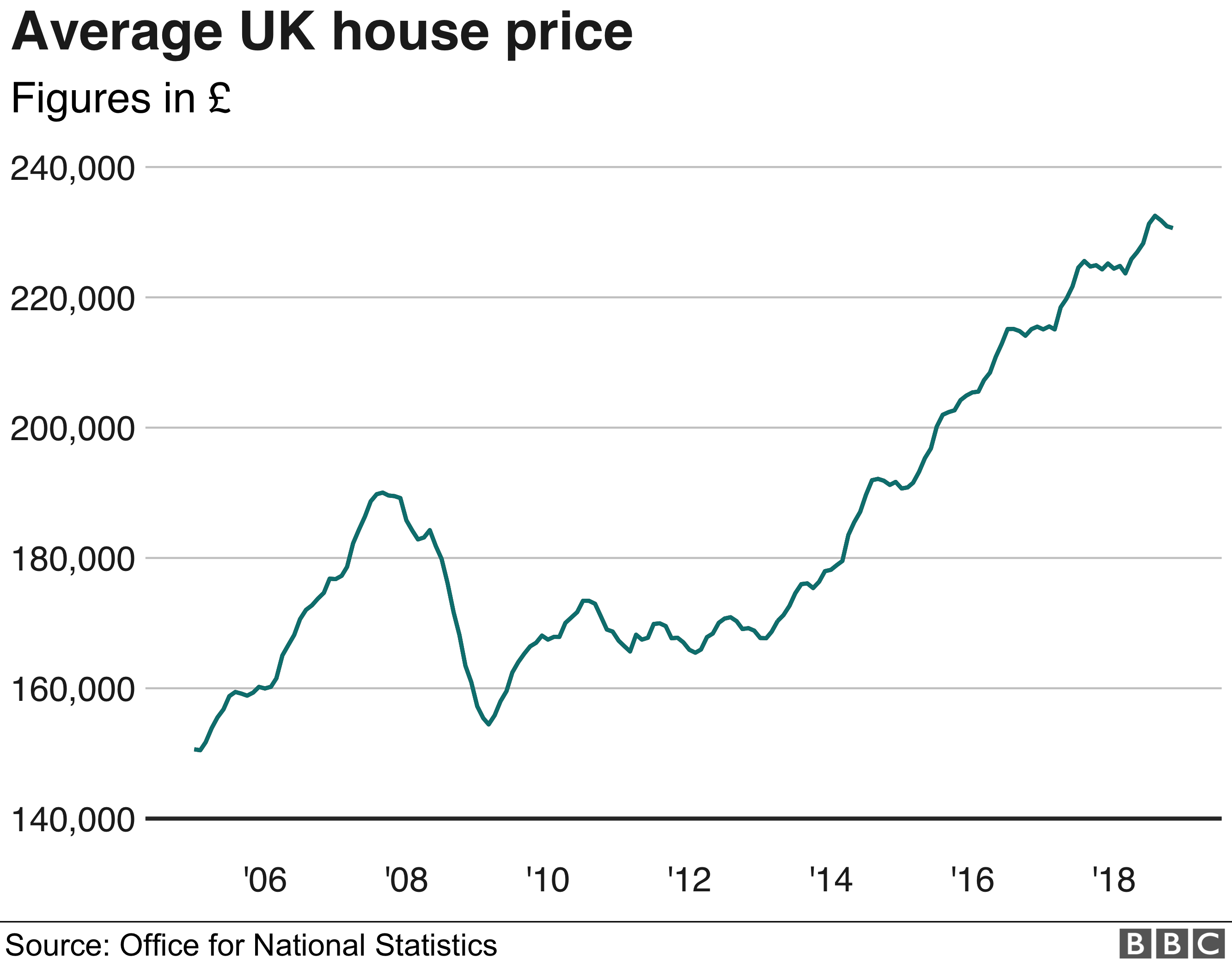

Image copyright Alex McClure With house prices having risen over the last decade, many young people have found it tough to get on the property ladder. Some are choosing to co-buy with friends, but it is not without its risks.

Courtney McClure is buying a six-bedroom house with her husband Alex and another couple in south London.

The deal is almost complete and the group is excited to make the property in Sydenham, which has a large garden and big communal spaces, their own.

Pooling their resources with another couple has enabled them to buy in a “much more appealing” location with better transport links than if they had bought a place separately, Courtney says.

“We’re getting a lot more for our money,” adds Alex, a 32-year-old sound engineer.

But money should never be the sole motivation to buy with friends, Courtney says. “It’s such a big thing. You’re sharing your world. I think if you were just doing it for cost reasons, you probably wouldn’t enjoy it.”

Image copyright Alex McClure

Image copyright Alex McClure Her view is echoed by Lucy Jordan who believes buying property with friends, or co-buying, is “the answer”.

Not only is it a wise choice financially, it is also the “best option”, because “people are better off living in groups”, she says.

“People are trying to decide how best to make the most of their lives,” says Lucy, who currently lives in Harlesden, north London. For her this means buying a property in or near Dover, with her partner and four friends.

The group has not laid their eyes on any particular places, but Lucy says: “We’re all quite passionate about it. It’s definitely the way we’re going to go.”

Are more people doing this?

M&S Bank believes there has been an increase in people co-buying. Last year it launched a “mortgage for four”, following research it says showed that the “majority of millennials would take out a mortgage with two or more people to get a foot on the property ladder”.

“The option of becoming a mortgage-mate is particularly appealing to those already in a housemate arrangement, and our research shows that the concept has become increasingly popular with millennials,” Paul Stokes, head of products at M&S Bank, said.

Mortgage brokers London & Country have detected a small increase in applications by groups of three or four, but spokesman David Hollingworth says this increase does not capture mortgages taken out by two friends, for example, and does not make clear if applicants have “parental backing”.

Though the phenomenon might be on the up, Alex McClure says when he and his co-buyers approached estate agents, “a lot of them seemed quite surprised – I think it’s still considered abnormal.”

Not all lenders offer group mortgages either. Nationwide, one of the UK’s largest mortgage lenders, for example, currently has a maximum of two people per mortgage.

What about the risks?

London & Country’s David Hollingworth warns that if one co-buyer wants to move on, this could create a situation where the “other co-buyers would either have to buy them out or if they can’t afford that, be faced with the prospect of selling the property”.

Even if four people’s names are on a mortgage, if one or more stop paying, the mortgage lender has the right to demand full repayments from whoever they can reach, he explains.

- Want to talk about affordable housing? Join our Facebook group here

- Where can I afford to rent or buy?

- How I bought a house without mum and dad

- Where does rent hit young people the hardest?

Sean Gilbert, a 40-year-old flooring contractor from Bedfordshire, says co-buying is “insanely risky”.

He now lives in his 16th rented property since leaving school, but says house prices have been “artificially inflated” by the buy-to-let market, and he is “resigned to never owning”.

But he would never consider co-buying. “There are virtually zero legal safeguards if someone wants to up and leave, taking their capital with them.”

‘In it together’

Lucy Jordan, however, has “complete trust” in her group.

“We’re all incredibly close, and if something were to happen that would mean one of us would become financially insolvent, I would want to support them. We’re all in it together. I see us more as a family,” she says.

There are, however, some ways to formalise co-buyers’ obligations towards each other.

Image copyright Alex McClure

Image copyright Alex McClure The McClures and their co-buyers have drawn up a deed of trust, which is a legal agreement used to specify how a property is held between its joint owners.

It sets out steps the group would take “if someone wants out”, Courtney explains.

“I don’t think anyone will have any hard feelings if someone is really honest and says, ‘I really hate this,’ and I think it’s better to do that and stay friends than put up with a terrible situation,” she adds.

For now though, the group of friends are excited to move in together – with one couple on each floor, and sharing the cost of any renovation and possibly childcare in a few years time.

As Alex puts it: “If you don’t have rich parents, how else are you going to get on the housing ladder?”

Where can you afford to live? Try our housing calculator to see where you could rent or buy

This interactive content requires an internet connection and a modern browser.

Your results

No affordable areas

Search the UK for more details about a local area

You have a big enough deposit and your monthly payments are high enough. The prices are based on the local market. If there are 100 properties of the right size in an area and they are placed in price order with the cheapest first, the “low-end” of the market will be the 25th property, “mid-priced” is the 50th and “high-end” will be the 75th.

Read more: https://www.bbc.co.uk/news/business-46895770

Leave a Reply