Fact Check: Do 83% of Trump’s tax cut benefits go to the 1%?

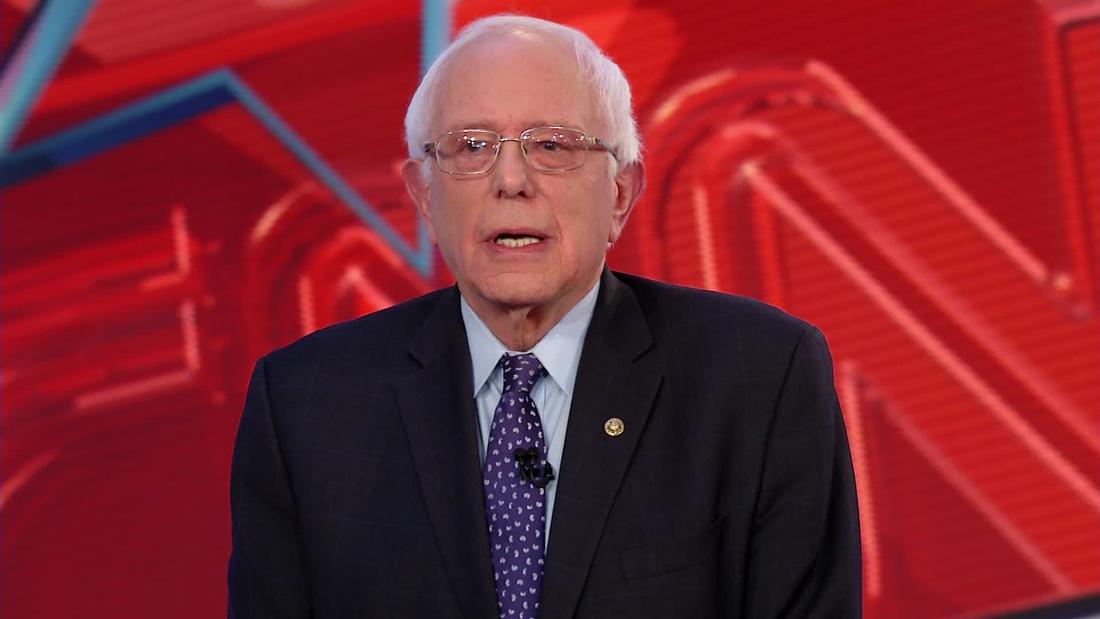

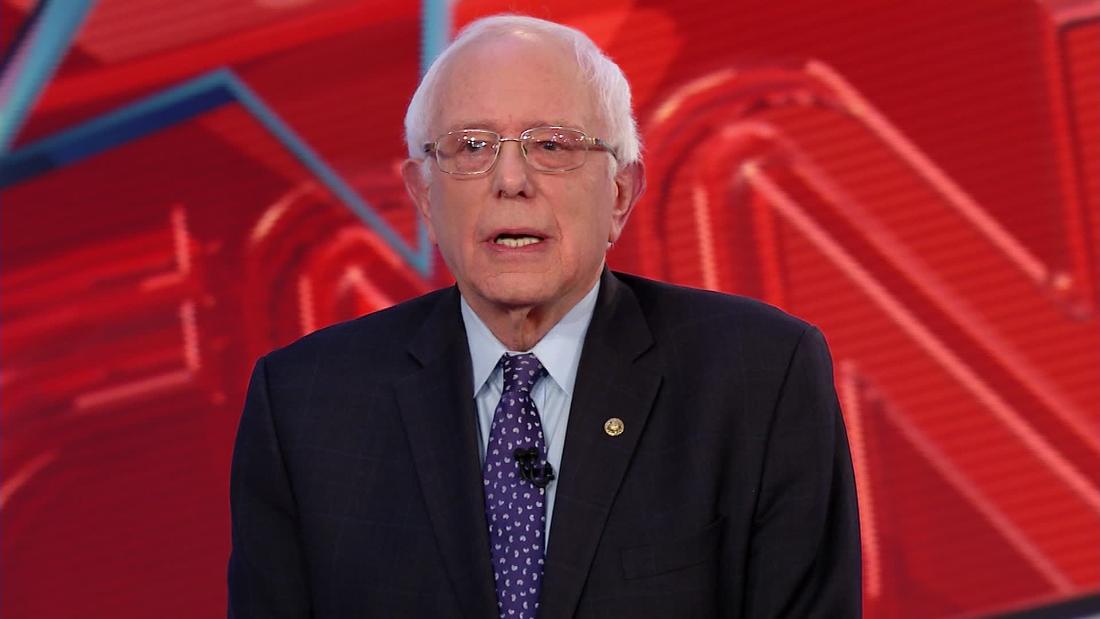

Washington (CNN)Sen. Bernie Sanders of Vermont appeared at a CNN presidential town hall Monday night. After his first question from the audience, Sanders argued that President Donald Trump “said he’d have a tax plan to benefit the middle class, but 83% of the benefits go to the 1%.”

Context

The tax reform passed in December 2017 included tax cuts for corporations as well as individuals — but while the benefits for business were permanent, the individual taxpayer cuts will expire by 2027. If Congress does nothing to extend them, the top 1% will at that point receive roughly 83% of the tax cut benefits, according to estimates from the nonpartisan Tax Policy Center.

The same study said that for the 2018 tax year, the top 1% would receive 20.5% of the benefits from the tax cuts.

Why the 10-year timeline? That’s thanks to Senate rules that allow tax cuts to pass with fewer than 60 votes if they won’t increase the deficit in 10 years — a necessity for Republicans to get the tax reform through.

But it’s possible that a future Congress and President would vote to extend Trump’s tax cuts — even if Democrats are in charge. A vast majority of the last major round of tax cuts passed by President George W. Bush were made permanent under President Barack Obama.

Read more: https://www.cnn.com/2019/02/26/politics/fact-check-sanders-town-hall-tax-cuts/index.html

Leave a Reply